the e-guide

- Settle for the price advertised

Settling for the price advertised is a common mistake many car buyers make. You may think you are getting a fair deal, but what you need to remember is that the asking price is just that – a starting point. Car dealers often mark up the price of the car to allow for negotiation, so it never hurts to ask for a lower price. You could save hundreds or even thousands of dollars by negotiating.

2. Settle for the price or value given for the trade-in

Another mistake car buyers make is settling for the value the car dealer gives on their trade-in. While it may seem like a hassle to sell your current car privately, it could be worth it in the end. Dealers are often looking to make the most profit they can, which often means giving a low value for your trade-in. By selling your car privately, you may be able to get a better price, which could go towards your new car purchase.

3. Settle for the interest rate quoted at time of purchase

The interest rate offered by the car dealer may also seem like a fair deal, but did you check your FICO score? Knowing your credit score and shopping around for the best interest rate can save you money in the long run. A lower interest rate may mean lower monthly payments and less interest paid over the life of the loan. Don’t settle for the first rate you are offered; do your research and find the best rate available to you.

4. Stuck because you become emotionally vested in a car

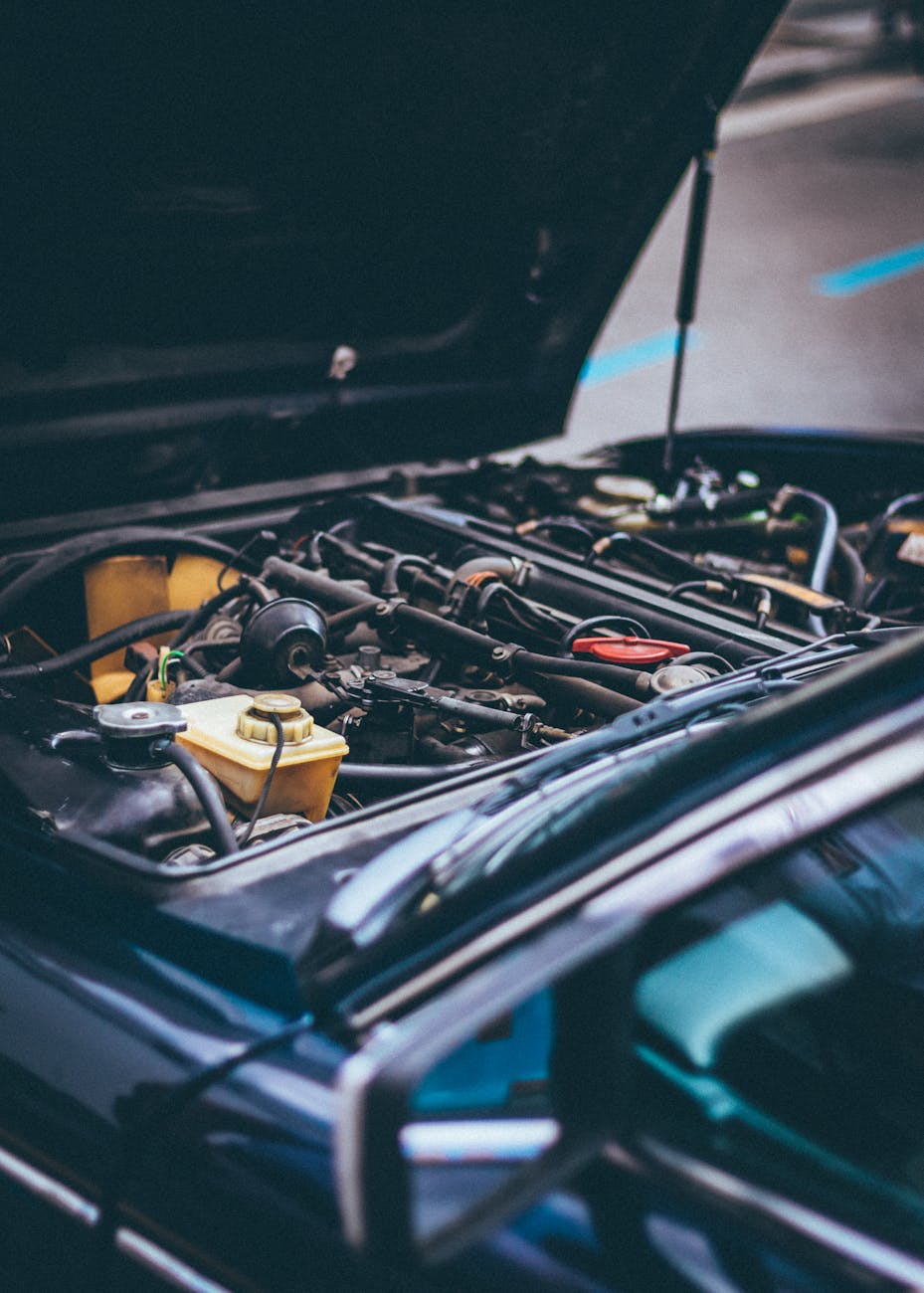

It is easy to get emotionally vested in the car you want to buy, even if it is out of your price range. They say not to judge a book by its cover, but when it comes to cars, many of us have a hard time not being swayed by a sleek exterior and a flawless paint job. However, as tempting as it may be to make a purchase based purely on looks, it’s important to keep in mind that there are other aspects of a vehicle that are just as crucial to consider.

5. Stuck because you did not know about the expenses that come with buying a car

What we see in this industry is the first payment default. It’s like that shock; if I had the baby now, what would I do with it?

The amount of down payment will depend on you the car buyer and your goals. The amount of the down payment will affect the positive equity you gain in your vehicle; more on that to come.

The auto insurance policy is separate and paid outside of the car payment. Some insurance companies will allow you to make monthly payments, whether it’s an automatic deduction or monthly ACH payment.

Every customer will pay the this fee and registration. When we decided to have kids, we started buying the necessities we needed a little at a time. The same applies to car buying: begin putting money aside when the decision is made to buy another vehicle.

Leave a comment